- Maryland Live Casino Tax Id Number Customer Service

- Maryland Live Casino Tax Id Number

- Maryland Live Casino Tax Id Number Online

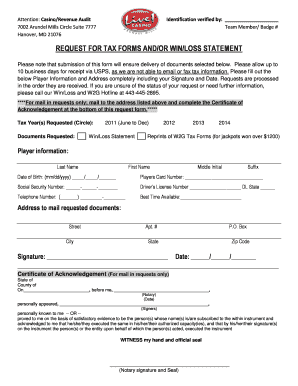

- Attention: Casino/Revenue Audit Identification verified by: 7002 Arundel Mills Circle Suite 7777 Hanover, MD 21076 Team Member/ Badge #.

- Attention: Casino/Revenue Audit Identification verified by: 7002 Arundel Mills Circle Suite 7777 Hanover, MD 21076 Team Member/ Badge # REQUEST FOR TAX FORMS AND/OR WIN/LOSS STATEMENT Please note that submission of this form will ensure delivery of documents selected below.

What is a Domestic Employer?

A Domestic employer is a person who has a worker in their home, working full or part-time. If during any calendar quarter of the current or preceding calendar year there is a total payroll of $1,000 or more to an individual(s) performing domestic service, the domestic employer is liable.

If a Domestic Employer is liable to pay quarterly unemployment insurance taxes, the employer must submit a Combined Registration Application no later than twenty days after the first day of services performed. Employers may use the following link to file the Combined Registration Application via the Internet at New Employer Account Registration or contact the Employer Status Unit at the telephone number listed below. The Division of Unemployment Insurance will establish an unemployment insurance account for the employer and assign a ten digit account number. A liable employer is required to file a Contribution and Employment Report each quarter.

A state employer identification number, also called an EIN, is an identification number businesses need to collect and pay state income tax.Only businesses that operate in states that do not collect personal income tax and sole proprietors that choose to use their Social Security number in place of a state EIN are exempt from holding a state EIN. The employer identification number (EIN) for Ppe Casino Resorts Maryland Llc is 264105452. EIN for organizations is sometimes also referred to as taxpayer identification number or TIN. Ppe Casino Resorts Maryland Llc sponsors an employee benefit plan and files Form 5500 annual return/report.

Questions should be directed to the Employer Status Unit, at 410-949-0033, or you may e-mail the unit at DLUICDEmployerStatusUnit-labor@maryland.gov.

What is the definition of 'employer'?

An employer is an individual or employing unit, which employs one or more individuals for some portion of a day. Besides the multitude of regular employers, such as manufacturers, retailers, etc., it also includes special types of employment that are sometimes overlooked by employers. These special types and liability requirements are:

- Agricultural Employer - if during any calendar quarter of the current or preceding year the employer paid cash remuneration of $20,000 or more to individuals performing agricultural labor; or employed at any time ten or more individuals for a portion of a day in any twenty weeks in the current or preceding calendar year, then the agricultural employer is liable.

- Domestic Employer - if during any calendar quarter of the current or preceding calendar year there is a total payroll of $1,000 or more to an individual(s) performing domestic service, then the domestic employer is liable.

- Farm Crew Leader - if a crew leader holds a valid certificate of registration under the Farm Labor Contractor Registration Act of 1963; or the crew leader provides mechanized equipment which substantially all the individuals operate or maintain, provided the individuals are not employees of another employer, then the farm crew leader is liable.

Employment is defined as any service performed for remuneration (payment) whether full-time or part-time. This also includes salaries paid to corporate officers who are employees of the corporation (including close and subchapter S corporations).

One of the most common employment exclusions is an 'independent contractor.' The criteria for independent contractor status are:

- The individual who performs the work is free from control and direction over its performance both in fact and under the contract; and

- The individual customarily is engaged in an independent business or occupation of the same nature as that involved in the work; and

- The work is: (a) outside of the usual course of business of for whom the work is performed, or (b) performed out-side of any place of business of the person for whom the work is performed.

When independent contractor status is in question, employers must document that all three of the criteria above are satisfied. An independent contractor should have the appropriate licenses, file business tax returns, and may have his/her own federal identification number and UI account number. The Code of Maryland Regulations (COMAR) provides additional guidance for making the proper determination regarding workers. The landmark Maryland Court of Appeals decision, DLLR v. Fox also provides insight into the analysis of the classification of independent contractor.

The following specific exemptions from covered employment are provided under Labor and Employment Article 8 when certain criteria are met:

- Barbers and Beauticians

- Taxicab Drivers

- Owner Operated Tractor Drivers In Certain E & F Classifications

- Maritime Employment

- Election Workers

- Church Employees

- Clergy

- Certain Governmental Employees

- Railroad Employment

- Newspaper Delivery

- Insurance Sales

- Real Estate Sales

- Messenger Service

- Direct Sellers

- Foreign Employment

- Other State Unemployment Insurance Programs

- Work-Relief and Work-Training

- Family Members

- Hospital Patients

- Student Nurses or Interns

- Yacht salespersons who work for a licensed trader on solely a commission basis

- Services of aliens who are students, scholars, trainees, teachers, etc., who enter the U.S. solely to pursue a full course of study at certain vocational and other non-academic institutions.

- Recreational Sports Officials

- Home Workers

- Casual Labor

Casual Labor is defined as work performed that is not in the course of the employer’s trade or business and which is occasional, incidental or irregular. Do not confuse “casual labor” with temporary or part-time employment, which is taxable. However, if during a calendar quarter the cash remuneration paid for casual labor is $50 or more and the casual labor is performed by an individual who is regularly employed by the employer on some portion of 24 days during the calendar quarter or the preceding calendar quarter, the service is covered employment, and remuneration is taxable under the law.

If there are any questions regarding the categories listed, call the Employer Status Unit at 410-767-2414 or toll free at1-800-492-5524.

How does my business register as a 'new' employer?

You can open an unemployment insurance employer account by filing a Combined Registration Form. Employers should submit a Combined Registration Form no later than 20 days after the first day of business. This single registration form covers obligations to seven State agencies. The employer only completes sections that apply to his/her business. You may file the application on the Internet at Maryland Comptroller's Office.

What are taxable wage inclusions and exclusions?

Taxable wages include total remuneration paid up to the taxable wage base limit of $8,500 before any deductions are made.

The following wages are taxable:

- Meal and lodging provided by an employer to an employee, unless the meals and lodging are provided on the employer's premises for the employer's convenience.

- Tips which are reported pursuant to Section 6053 of the Internal Revenue Code.

- Payments to workers for: (a) dismissal; (b) vacations; (c) sick leave (for first six months only); and (d) advances to employees for travel or other expenses for which no accounting or reporting to employers is required.

- Payments by the employer of the employee's share of Social Security (except for payments made by domestic and agricultural employers).

Notation: The Federal Unemployment Taxable (FUTA) wage base remains unchanged at $7,000.

The following wages are not to be reported:

- Value of any special discount or markdown allowed to a worker on goods or services purchased from or supplied by the employer where such purchase is optional with the worker.

- Payments toward retirement or a death benefit if the employee has no right to receive cash instead, or to assign his/her rights therein, or to receive a cash payment in lieu thereof on withdrawal from, or termination of such insurance plan or upon termination of his/her employment.

- Facilities or privileges (such as entertainment, cafeterias, restaurants, medical services, or so-called 'courtesy discounts' on purchases) furnished or offered by an employer merely as a convenience to the worker or as a means of promoting health, goodwill, or efficiency of his/her workers.

- Discounts on property or security purchases.

- Customary and reasonable directors' fees.

- Supper money given to a worker to compensate him/her for the additional cost of a meal made necessary by working overtime.

- Payments by the employer to or on behalf of an employer for sickness or accident disability after the expiration of six calendar months.

- Wages of a sole proprietor, his/her spouse and children of the sole proprietor under 21 years old, and owner's parents.

- Wages of partners (wages of spouses are taxable). For example - If two brothers own a business:

- Wives work in the business - covered employment, wife is not same relationship to both partners; or,

- Parents work in the business - exempt, same parent relationship to both partners.

- Wages earned by an individual who is enrolled in a full-time educational program that combines academic instruction with work experience, which is an integral part of the educational program.

- Employee pretax contributions and salary reductions or deductions under IRS Section 125 cafeteria plans in order to purchase the following benefits: accidental and health insurance, life insurance, or dependent care assistance.

If there are questions concerning the inclusions and exclusions listed, please call the Unemployment Insurance Employers Line on 410-949-0033 in the Baltimore area or toll-free on 1-800-492-5524.

What is a 'reimbursable' employer (not-for-profit and government entities)?

Not-for-profit organizations classified under Section 501(c)(3) and exempt from income tax under Section 501(a) of the Internal Revenue Code, and state and local government entities and subdivisions may elect to finance their UI costs by reimbursing the state dollar for dollar for benefits charged against their accounts, in lieu of paying quarterly UI taxes. Not-for-profit organizations are required to post a bond of a specific dollar amount. Questions concerning not-for-profit status and/or requirements may be directed to the Unemployment Insurance Employers Line on 410-949-0033 for callers in the Baltimore area or toll free on 1-800-492-5524.

Maryland Live Casino Tax Id Number Customer Service

The election of the reimbursement method for newly formed not-for-profit organizations must be made in writing to the agency within 30 days of coverage under the law. Once electing the reimbursement method, Maryland law only permits an employer to change his/her option after two years on written notice to the Assistant Secretary not less than 30 days prior to January 1 of the year the new options becomes effective (if approved).

Billing for benefits chargeable to the not-for-profit organization or government entities is made via the 'Statement of Reimbursable Benefits Paid,' (DLLR/DUI 64-A). This quarterly statement lists all claimants collecting benefits during the previous quarter. Organizations receiving this form have 15 days from the 'Date of Invoice' to file a written protest. Interest is charged for any late payments.

What if my business has employees working in several states?

Services performed within this state, or both within and without this state are to be reported to Maryland if:

- The service is localized in Maryland; or,

- When there is employment in more than one state and some service is performed in the state where the base of operations is located, then the earnings are to be reported to that state where the individual's base of operations is located. If no services are performed in the state with the base of operations and some services are performed in the state where direction or control is received, then the earnings are to be reported to the state where the individual's direction or control is received. If there are no services performed in the state where the base of operations is located or where direction or control is received, then the individual's state of residence is to be used.

The objective is for all services performed by an individual for a single employer to be covered under one state law, wherever the services are performed. Employers may elect to cover an employee through a Reciprocal Coverage Agreement between states. For additional information, contact the Unemployment Insurance Employers Line on 410-949-0033 in the Baltimore area or toll free on 1-800-492-5524.

How are my tax rates determined?

Maryland employers are assigned one of three different types of tax rate: the new account rate, the standard rate, or the experience (earned) rate.

New Account Rate

'New Employer' means an employing unit that does not qualify for an earned rate. The tax rate for a new employer will be the average of the rates for all employers in the State during the last five years. Construction companies headquartered in another state will be assigned a tax rate that is the average of the rates for all construction employers in Maryland during the year for which the rate is assigned.

Standard Rate

If an employer is eligible for an earned rate, but has no taxable wages in a fiscal year (July 1 to June 30) because the employer failed to file its quarterly tax and wage reports, the employer is assigned the standard rate. The standard rate is the highest rate from the 'Table of Rates' that is in effect for the year.

Experience (Earned) Rate

After an employer has paid wages to employees in two rating years (July 1 to June 30) prior to the computation date (July 1st prior to the rated year), he/she is entitled to be assigned a tax rate reflecting his/her own experience with layoffs. If the employer's former employees receive benefits regularly which result in benefit charges, the employer will have a higher tax rate. On the other hand, firms which incur little or no benefit charges will have lower tax rates.

The earned rate is determined by finding the ratio between the benefits charged to your account and the taxable wages that you reported in three fiscal years prior to the computation date. If you have only been in business for two fiscal years prior to the computation date, just the experience in those two years is used. The benefit ratio is then applied to the Tax Table in effect for the year. The table in use for a particular calendar year is determined by measuring the adequacy of the Maryland UI Trust Fund to pay benefits in the future. There are six (6) tables, ranging from the lowest (A) to the highest (F). See the Employer Quick Reference Guide for more information.

Transfer of Experience Rate

Frequently, an employer will acquire its business from a previous owner or the employer will reorganize his/her business. The effect of various transactions on the employer’s contribution rate are summarized below:

- New Employing Unit Acquired Business - When a new business entity is formed and it acquires assets, employees, business, organization, or trade from another employer, the new business entity is classified as a successor employer. If there is any common ownership, management or control between the successor employer and the former employer (predecessor), the predecessor’s tax rate and experience rating is transferred to the successor. If there is no common ownership, management or control with the predecessor employer, no experience rating is transferred and the new business entity is assigned the new account rate.

Common ownership - There is common ownership, management or control when any person serves in any of the following positions for both the predecessor and successor:

(1) Sole proprietor (includes spouse, children and parents of sole proprietor);

(2) Partner of a partnership;

(3) Member of a limited liability company;

(4) Chief Executive Officer;

(5) Chief Financial Officer;

(6) Any corporate officer; or

(7) Any shareholder owning, directly or indirectly, more than50% of a corporation’s stock.

Taxable Wage Calculation: When calculating the amount of tax-able wages for the quarterly contribution report in the year of the acquisition, a successor employer that assumed the experience rating of a predecessor should make the calculation for each employee based on wages paid to the employee by the predecessor and successor. If a successor employer does not assume the experience rating of the predecessor because there is no common ownership, management or control with the predecessor, the successor may not compute taxable wages based on wages paid by the predecessor. See the section 'Reporting of Taxable Wages' for more information regarding the taxable wage calculation. - Existing Employing Unit Acquired Business – When an existing business entity acquires assets, employees, business, organization, or trade from another employer, the existing business entity is classified as a successor employer. The successor continues to pay contributions at the previously assigned rate from the date of transfer through the next December 31. The successor’s tax rate for the year following the acquisition is a blended rate that includes the predecessor’s experience. Taxable Wage Calculation: When calculating the amount of taxable wages for the quarterly contribution report in the year of the acquisition, a successor employer that assumed the experience rating of a predecessor should make the calculation for each employee based on wages paid to the employee by the predecessor and successor. See the section 'Reporting of Taxable Wages' for more information regarding the taxable wage calculation.

- A New Employer or An Existing Employer is not a successor if:

(1) the employer acquires less than 50% of the employees of the predecessor employer;

(2) the predecessor continues to pay wages to the remaining employees after the acquisition of employees in the quarter following the acquisition of employees by the employer; and

(3) other than the transfer of workforce, the employer does not acquire any tangible or intangible assets from the predecessor employer.

Taxable Wage Calculation: When calculating the amount of taxable wages for the quarterly contribution report, a new employer or existing employer which is not classified as a successor employer must compute taxable wages for each employee based on wages that it paid and not on wages paid by any previous employer. See the section 'Reporting of Taxable Wages' for more information regarding the taxable wage calculation. - Reorganized Employer A reorganized employer is an employing unit that alters its legal status such as changing from a sole proprietor to a corporation. The reorganized employer shall continue to pay at the contribution rate of the employing unit before the reorganization from the date of the reorganization through the next December 31.Taxable Wage Calculation: When calculating the amount of tax-able wages for the quarterly contribution report in the year of the reorganization, a reorganized employer makes the calculation for each employee based on wages paid to the employee before and after the reorganization. See the section 'Reporting of Taxable Wages' for more information regarding the taxable wage calculation.

- Out-of-State Transfers – Employers transferring all or part of their business from another state to Maryland may be eligible to transfer their experience rate to Maryland. Contact the Experience Rate Unit at 410-767-2413 for additional information regarding out-of-state transfers.

Taxable Wage Calculation: When calculating the amount of tax-able wages for the quarterly contribution report in the year of the transfer from another state, an employer should make the calculation for each employee based on wages paid to the employee before and after the transfer. See the section “Reporting of Taxable Wages” for more information regarding the taxable wage calculation. - Penalties:

(1)The law provides for penalties if an employer “knowingly” withholds or provides false information regarding the transfer of experience rating. If an employer is penalized under Section 8-614 of the Law, the employer would be assigned the highest tax rate in the year of the violation and in each of the next three years. If the employer was already at the highest tax rate for any year, or if the amount of the increase would be less than 2% for that year, then a 2% penalty rate would be assigned. The employer who knowingly violates the law regarding successorship would be guilty of a misdemeanor and on conviction would be subject to imprisonment not exceeding one (1) year or a fine not exceeding $10,000 or both.

(2)The law also provides for civil and criminal penalties against a person who is not the employer if the person violates, or attempts to violate, or “knowingly” advises an employer in a manner that causes the employer to withhold or provide false information regarding the transfer of experience rating. The person who is not the employer would be subject to a civil penalty of not more than $5,000. The per-son who is not the employer would be guilty of a misdemeanor and on conviction would be subject to imprisonment not exceeding one (1) year or a fine not exceeding $10,000or both.

Complete the Business Transfer Report in order to report the transfer of workforce/payroll from one business entity to another business entity.

For additional information regarding “employer rates,” contact the Experience Rate Unit at 410-767-2413 or toll free at 1-800-492-5524.

What is SUTA dumping?

SUTA is an acronym for State Unemployment Tax Act, and 'dumping' refers to the unlawful actions of an employer to pay at a lower unemployment insurance tax rate than should be assigned. Instead of paying unemployment insurance taxes at a rate based on its own experience with layoffs and payrolls, an employer attempts to avoid a higher rate that would otherwise have been based on its experience. Most frequently, it involves merger, acquisition or restructuring schemes, especially those involving the shifting of workforce / payroll from one business entity to another. The Maryland Division of Unemployment Insurance has invested in new computer software to detect SUTA Dumping and the Maryland legislature has enacted a law change to penalize an employer who knowingly withholds or provides false information regarding the transfer of workforce / payroll from one business entity to another. Penalties include a higher unemployment insurance tax rate, monetary fines and even imprisonment. The best way to avoid getting caught in SUTA Dumping is to voluntarily notify the Division of Unemployment insurance when workforce / payroll is shifted from one business entity to another and to readily provide information to the Division, if requested.

How does my business file quarterly reports and returns?

Maryland employers are required to report the amount of total 'gross wages' paid each quarter. Employers should file online using the new BEACON 2.0 system. Gross wages include all remuneration for personal services, including commissions and bonuses and the cash value of all compensation in any medium other than cash. Employers must also calculate and report the amount of total 'taxable wages.' For Maryland unemployment insurance purposes, 'taxable wages' are defined as the first $8,500 earned by each employee in a calendar year.

You are required to report your payroll and pay unemployment insurance taxes four times a year. You have one month following each quarter to file reports and pay the tax. You must file on time in order to:

- Receive maximum credit for your state payments against Federal Unemployment Tax (FUTA) payments;

- Receive credit for your payroll in 'experience rating'; and,

- Avoid interest charges at a rate of 1.5% per month for late payments and a penalty assessment of $35 for each late report.

Accuracy when reporting the taxable wages is extremely important. It affects the amount of taxes owed and your tax rate. In Maryland, an employer's 'benefit ratio' is determined by dividing the amount of benefits charged against the employer's account by the amount of taxable wages.

Maryland employers are required to file wages and tax returns each quarter. Each return covers the activity during the calendar quarter. The return is due by the end of the month following the end of the quarter. Payment is due with the return.

How can my business pay its unemployment insurance taxes?

Maryland employers are required to pay their quarterly unemployment insurance taxes by the quarterly due date, four (4) times each year. For employers filing in the BEACON system:

Maryland Live Casino Tax Id Number

- Pay by E-Check (free) at the time of the filing, through BEACON

- Pay by paper check and mail to P.O. Box 17291 Baltimore, MD 21297-0365

- Pay by ACH Credit after obtaining approval from the Maryland Department of Labor by using the Electronic Funds Transfer Guide.

How does an employer compute excess wages for the quarterly contribution report?

An employer pays taxes on the first $8,500 of wages paid to an employee in the calendar year. An example of excess wages for one individual follows: If an employee earned exactly $8,500 in the first quarter of the calendar year, the employer would have zero excess wages in the first quarter because the entire amount of wages is taxable. If the employee earned $7,000 in the second quarter of the same calendar year, the amount of excess wages in the second quarter would be $7,000 because the employer had paid taxes on the first $8,500 in the first quarter. Apply this calculation to all employees to determine excess wages for each employee, and then add excess wages for all employees. This grand total is entered as excess wages for your filing. For additional help computing excess wages, please visit your BEACON employer portal.

How are benefits charged to the employer account?

When an individual files a claim for benefits, two determinations are made. The first is a monetary determination of the amount of benefits the claimant may receive based on his/her wages paid in a specified time period (base period). The second is a non-monetary determination that considers the claimant's eligibility for benefits and reason for separation from employment. Both determinations affect the charging of benefits against an employer's account.

Maryland Live Casino Tax Id Number Online

The gross wages paid to a claimant by all employers in the base period are used in determining a UI claimant's weekly benefit amount (WBA). An employer's percentage of charging for UI benefits is based on the following elements:

- Base Period Gross Wages Paid by the Employer - The base period is defined in Maryland's Unemployment Insurance Law as the first four of the last five completed calendar quarters prior to the filing of the claim, and is used to establish eligibility for benefits.

- Percent of Liability - If a claimant has only one employer in the base period, the employer's account would be charged for 100% of any benefits paid and chargeable. If the claimant had two or more employers during the base period, all employer charges are pro-rated based proportionately on the wages the employer paid to total wages paid. The percentage of charges is rounded to the nearest hundredth part for each base period employer.

The percentage, times the total amount of benefits ultimately received by the claimant while employed, equals your benefit charges. You are notified of the exact amount of charges at the end of each calendar quarter.

Benefits charged to your account will usually increase your tax rate and will result in higher tax payments that will enable the UI Trust Fund to recover the benefits paid over a three-year period. Of course, the best way to minimize unemployment insurance costs is to avoid layoffs. The Maryland Unemployment Insurance Law provides for 'Work Sharing,' which makes it cheaper to keep employees on the payroll, perhaps at reduced hours during a slack period instead of a complete layoff. Care should be exercised when hiring employees, especially for temporary positions. Ensure that a new hire is qualified in order to avoid a potential layoff situation.

Some employers find it advantageous to hire a student or a person with a steady full-time job for a temporary position because that individual may not be as likely to file a claim for unemployment insurance benefits after the temporary job ends.

Finally, document unsatisfactory work performance and the reasons for separation, should it be necessary to contest a claim filed by an individual. The Maryland Unemployment Insurance Law provides that your account is not charged for benefits in certain situations.

Are there non-charges and credits?

Specific provisions of the Maryland Unemployment Insurance Law and regulations provide for relief from benefit charging and credits for repayments. Non-charging does not affect entitlement or eligibility. Claimant, if eligible and qualified, may still collect benefits. The non-charging provisions are not applicable to reimbursable employers. Except for number 7 below, the non-charging provisions are not applicable to reimbursable employers.

The list below indicates reasons for non-charging and credit provisions:

- Voluntary quit without good cause attributable to the employment.

- Voluntary quit for a better job.

- Voluntary quit to attend approved training.

- Discharge for reasons which constitute gross misconduct in connection with the work.

- Discharge for reasons which constitute aggravated misconduct in connection with the work.

- If the claimant is originally granted and paid benefits, but as a result of a redetermination or an appeal is later disqualified, a credit will be given, except to reimbursing employers, for benefits paid prior to the redetermination or the appeal decision. Credits will only be given to reimbursing employers when the claimant repays any benefits improperly paid. Subsequent benefits will only be charged if the claimant resolves the disqualification and the benefits are otherwise payable.

- Part-time/full-time employment - If a claimant loses his/her full-time job, but continues to work his/her part-time job, partial benefits received by the claimant will not be charged to the part-time employer's account as long as the claimant remains actively employed. Employers receiving a 'Request for Separation Information' (DLLR/DUI 207) for claimants actively employed on a part-time basis should clearly indicate the claimant's continued part-time status.

How can my business file a protest or ask a question about the employer account?

Employers can appeal a liability determination, a benefit charge, or a tax rate assignment in writing within 15 days of the decision. Follow instructions indicated on the forms you receive to determine the proper address to which to submit your appeal.

The employer should include in the protest or appeal the employer's name, the employer's account number, the name and title of the individual submitting the protest, the date of the protest, and most importantly, the specific factual reason for the protest or appeal. The employer should attach any documentation that supports their contention. The Division of Unemployment Insurance will respond to the employer's protest by issuing a Review Determination.

Can my business get information about the employer account over the Internet?

The Maryland Unemployment Insurance Employers BEACON system is your secure source for online employer information. This is what you can do online today:

- File and pay your taxes online

- File quarterly wage reports

- View benefit charge statements and annual tax rate information

- File appeals

- Provide separation information

- Manage powers of attorney

- Make account updates

You will need to activate your account in BEACON before logging in. Please visit the UI Modernization Account Activation page for additional information on how to activate your BEACON account.

How do I contact the Division of Unemployment Insurance with any questions I may have about my employer account?

The Division has developed additional ways for you to resolve any issues or questions that you may have. There is a new Inquiry Form. This form is the most efficient way for you to ask a question of the Division. Submit a description of your issue or inquiry, and you will receive a tracking number that will allow you to follow up on your inquiry.

You may also contact the Division’s Employer Call Center. Call 410-949-0033 to contact the Division's Contributions Unit and be connected with the appropriate staff to handle your inquiry.

How do I change my address?

You may change your address online in BEACON.

How do I verify my tax payment?

You may view the payments you have made in the BEACON system.

What is the Maryland New Hire Registry and what is my responsibility as a Maryland employer?

Federal and State law requires all employers who are covered under the Maryland Unemployment Insurance Law to report all employees who are hired or rehired to a central registry within 20 days of the employee's first day of work. Employers are required to report the following information:

- Employee's name and Social Security Number

- Employee's home address

- Employee's first physical day of work on the job

- Employer's name and address

- Maryland State Unemployment Insurance Ten Digit Account Number

- Federal Employer Identification Number

- Whether health insurance is available

Several additional data elements may be reported on a voluntary basis. For more information contact the Maryland New Hire Registry Help Desk at 410-281-6000 or 1-888-MDHIRES, Fax # 410-281-6004, Toll Free Number 1-888-657-3534.

Maryland Report of Hire website

The New Hire Registry is a tool that the State of Maryland/Maryland Department of Labor utilizes to protect against unemployment insurance overpayments and fraud. Employer participation in this program is mandatory and helps protect the Maryland UI Trust Fund from individuals who continue to file after finding gainful employment.